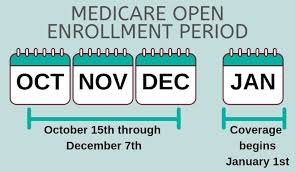

For many older adults and their caregivers, Medicare Open Enrollment (October 15 – December 7 each year) can feel like an overwhelming maze of forms, choices, and fine print. As an eldercare provider, you are in a unique position to help clients and families navigate with less stress and more confidence. Even if you don’t give direct insurance advice, understanding the basics allows you to guide them toward the right resources at the right time.

Here are five essential things to know so you can be supportive, informed, and proactive.

1. Open Enrollment Isn’t for Everyone — But It’s Crucial for Many

Not all Medicare participants need to take action during Open Enrollment, but those who want to make changes to their Medicare Advantage (Part C) or Prescription Drug Plans (Part D) can only do so during this window.

Key points to remember:

- Traditional Medicare (Parts A & B) doesn’t require annual renewal, but supplemental coverage often does.

- Clients can switch from Original Medicare to a Medicare Advantage plan, or vice versa.

- They can change from one Medicare Advantage plan to another, or alter their Part D prescription coverage.

Why it matters for eldercare companies:

If you hear a client or caregiver expressing frustration about medication costs, provider networks, or service coverage, this is the time to suggest they explore other options.

2. Medication Coverage Can Change Every Year

One of the most common (and costly) surprises seniors face is that their prescription drug coverage can shift from year to year.

Things to note:

- Formularies (the list of covered medications) can change annually.

- Copay amounts and preferred pharmacy networks may shift.

- Some medications may move to a higher cost tier or drop from coverage altogether.

How you can help:

Encourage clients and caregivers to review their Annual Notice of Change from their insurance plan and compare it against their current medication list. A quick review now can prevent a major cost shock in January.

3. Provider Networks Aren’t Always Stable

Medicare Advantage plans operate with provider networks, and these can change each year.

Risks to clients:

- A favorite physician, specialist, or hospital may no longer be “in network.”

- Out-of-network care can be significantly more expensive or not covered at all.

Your role:

If you become aware of a client’s healthcare providers changing networks, suggest they verify network status before Open Enrollment ends. Even a single phone call to their insurance provider can prevent disruption to care.

4. Free, Unbiased Help Is Available

Seniors and caregivers often feel pressured by TV ads, mailers, or sales pitches. They may not realize there are free, unbiased counseling resources available.

Two key resources:

- State Health Insurance Assistance Programs (SHIPs): Offer one-on-one help with plan comparisons and enrollment questions.

- Medicare.gov Plan Finder: Allows clients to compare plans, costs, and coverage in their area.

Best practice for eldercare companies:

Maintain a quick-reference list of local SHIP offices and the Medicare.gov link so you can hand it to clients or email it to families.

5. Caregivers Need to Be Included in the Process

Many seniors rely on family members or friends to help with decision-making especially if there are cognitive or health challenges.

Why inclusion matters:

- Caregivers often manage medications, coordinate doctor visits, and monitor out-of-pocket costs.

- Being part of the review process ensures no detail gets overlooked.

Practical support tip:

Encourage clients to complete a Medicare Authorization Form so their chosen caregiver can speak to Medicare on their behalf. Without this, caregivers may be blocked from making inquiries or changes.

In Conclusion, the Bottom Line

As an eldercare company, your role isn’t to sell or recommend specific Medicare plans, it’s to be an informed ally. By knowing the basics of Medicare Open Enrollment, you can help clients and their caregivers feel less anxious, make informed decisions, and maintain continuity of care.

A small reminder or resource shared at the right time can make the difference between a smooth January and a stressful one.